Historical Price Trend Analysis: The Definitive Strategic Guide for Market Leaders

Strategic pricing managers and market analysts face an increasingly complex challenge: decoding the intricate signals hidden within historical pricing data. Without a comprehensive approach to trend analysis, organizations risk misaligning their product positioning, overlooking critical market signals, and potentially leaving significant revenue opportunities unexplored.

This guide will unpack a methodical framework for transforming raw pricing information into actionable strategic insights. By dissecting historical price trends, you'll learn how top-performing organizations translate data into precise, market-responsive pricing strategies that consistently outmaneuver competitors.

Understanding the Basics of Historical Price Trend Analysis

Historical price trend analysis is a strategic data examination process that tracks and interprets pricing movements across specific time periods, revealing critical market patterns and underlying economic dynamics. At its core, this analytical approach transforms raw price data into a strategic narrative that illuminates market behaviors, competitive positioning, and potential future scenarios.

For strategic pricing managers, this methodology goes beyond simple number-crunching. It represents a sophisticated diagnostic tool that decodes complex market signals. By systematically mapping price fluctuations, organizations can uncover hidden insights such as seasonal variations, competitive pricing strategies, and emerging market demand shifts that traditional analysis might overlook.

The fundamental value lies in its predictive power. Strategic pricing teams can leverage these insights to make proactive decisions, anticipate market changes, and develop pricing models that are not just reactive, but strategically preemptive. Whether managing product portfolios, negotiating contracts, or developing market entry strategies, historical price trend analysis provides a data-driven compass for navigating competitive landscapes.

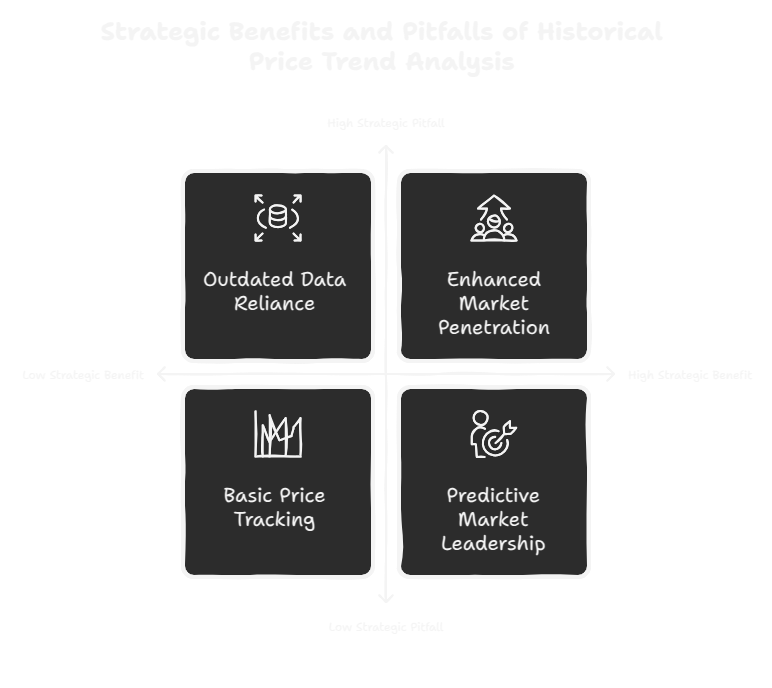

Why Historical Price Trend Analysis Matters for Your Business

For B2B companies and SMBs navigating complex market environments, historical price trend analysis is not just a theoretical exercise—it's a strategic survival tool. By transforming raw pricing data into actionable intelligence, organizations can fundamentally reshape their competitive positioning and decision-making frameworks.

Key Business Benefits

- Enhanced Market Penetration: Understanding historical pricing patterns enables precise market entry strategies, allowing businesses to identify optimal price points that attract customers while maintaining profitability.

- Improved Product-Market Fit: Trend analysis reveals how pricing correlates with customer demand, helping companies align their offerings more precisely with market expectations.

- Risk Mitigation: By identifying cyclical market patterns and potential pricing volatilities, organizations can develop more resilient financial strategies and hedge against unexpected market shifts.

- Competitive Intelligence: Systematic price trend tracking provides insights into competitor pricing strategies, enabling more informed strategic responses.

Common Strategic Pitfalls to Avoid

Many businesses undermine their pricing strategies by:

- Relying on outdated or incomplete historical data

- Failing to integrate quantitative pricing analysis with broader market context

- Treating price trend analysis as a one-time event instead of a continuous process

- Overlooking industry-specific nuances that impact pricing dynamics

Strategic pricing managers who master historical price trend analysis transform data into a powerful competitive advantage, moving beyond reactive pricing to predictive market leadership.

Strategic Framework: Executing Effective Historical Price Trend Analysis

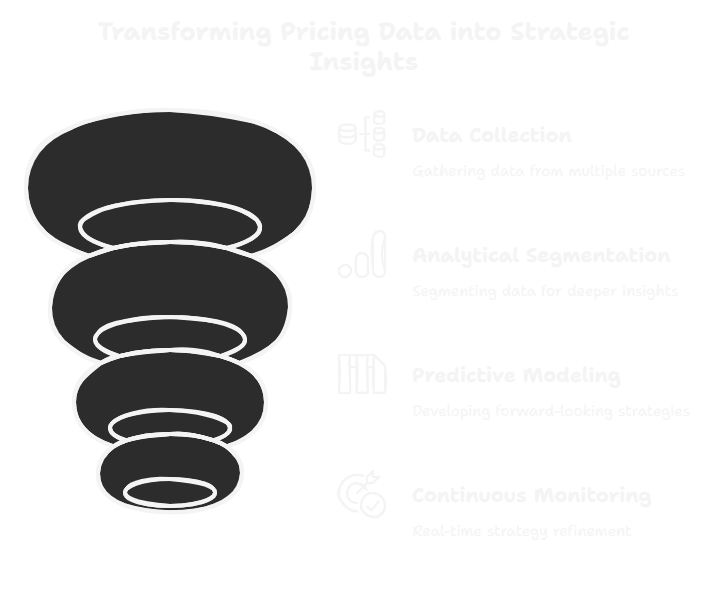

Transforming historical pricing data into strategic insights requires a systematic, multi-dimensional approach. The following framework provides strategic pricing managers with a robust methodology to extract maximum value from their pricing intelligence.

Step 1: Data Collection and Aggregation

Begin by establishing a comprehensive data collection strategy that spans multiple sources and timeframes.

- Sources to Consider:

- Internal sales records

- Market research platforms

- Industry benchmarking reports

- Regulatory financial databases

Pro Tip: Invest in robust data management tools that can integrate multiple data streams and provide normalized historical pricing information.

Mistakes to Avoid:

- Relying on limited or single-source data

- Neglecting data quality and consistency checks

Step 2: Advanced Analytical Segmentation

Segment pricing data across critical dimensions to reveal nuanced market insights.

- Recommended Segmentation Layers:

- Geographical market variations

- Product category performance

- Seasonal fluctuations

- Competitive landscape shifts

Pro Tip: Utilize statistical clustering techniques to identify non-obvious pricing patterns that traditional analysis might overlook.

Step 3: Predictive Modeling and Scenario Planning

Leverage historical data to develop forward-looking pricing strategies.

- Key Modeling Techniques:

- Regression analysis

- Machine learning forecasting

- Monte Carlo simulations

Mistakes to Avoid:

- Over-relying on historical patterns without considering emerging market dynamics

- Failing to incorporate qualitative market intelligence

Step 4: Continuous Monitoring and Adaptation

Establish a dynamic pricing intelligence framework that allows for real-time strategy refinement.

- Implementation Strategies:

- Create automated pricing dashboards

- Schedule regular strategic review cycles

- Develop rapid response protocols for significant market shifts

Pro Tip: Design flexible pricing models that can quickly adapt to detected market signals without compromising long-term strategic objectives.

Essential Tools and Frameworks for Strategic Price Trend Analysis

Executing a robust historical price trend analysis requires sophisticated tools and proven frameworks that transform complex data into strategic insights. The right technological ecosystem can dramatically enhance an organization's pricing intelligence capabilities.

Recommended Tools

-

Tableau

A powerful data visualization platform enabling strategic pricing managers to create interactive dashboards that translate complex pricing trends into intuitive visual narratives. Ideal for identifying patterns across multiple market segments.

-

PriceMetrix

Specialized pricing analytics software designed for B2B environments, offering advanced segmentation, competitive benchmarking, and real-time pricing optimization algorithms.

-

Bloomberg Terminal

Comprehensive financial data platform providing granular market intelligence, historical pricing datasets, and sophisticated analytical capabilities for enterprise-level market research.

-

Power BI

Microsoft's business intelligence tool that integrates seamlessly with existing enterprise data systems, offering machine learning-enhanced pricing trend forecasting and reporting.

Strategic Frameworks

-

Value-Based Pricing Framework

A dynamic approach that aligns pricing strategies directly with perceived customer value, utilizing historical trend analysis to understand market willingness to pay and optimize pricing models.

-

Competitive Pricing Intelligence Framework

A systematic methodology for tracking and responding to competitive pricing movements, integrating historical trend analysis with real-time market intelligence to maintain strategic positioning.

-

Dynamic Pricing Optimization Framework

An adaptive framework that leverages machine learning and historical pricing data to create responsive, data-driven pricing strategies that can quickly adjust to market fluctuations.

Strategic pricing managers can amplify their analytical capabilities by selecting tools and frameworks that align with their specific industry requirements and organizational complexity. The key is developing a flexible, data-driven ecosystem that transforms historical pricing information into actionable strategic insights.

Conclusion: Mastering Historical Price Trend Analysis for Strategic Advantage

Navigating the complex landscape of pricing trends requires a sophisticated, multi-dimensional approach that transcends traditional data analysis. By integrating advanced statistical methodologies, machine learning algorithms, and comprehensive market intelligence, strategic pricing managers can transform historical price data into actionable insights that drive competitive positioning and optimize revenue streams. The most successful organizations recognize that price trend analysis is not merely a retrospective exercise, but a dynamic, predictive tool that enables proactive strategy development, risk mitigation, and market anticipation. As technological capabilities continue to evolve, professionals who leverage sophisticated analytical frameworks, embrace cross-sector data integration, and maintain a holistic view of market dynamics will be best positioned to extract meaningful strategic value from historical pricing intelligence.