How to Calculate ROI for Pricing Strategies: A Comprehensive Guide

What if a single pricing strategy adjustment could increase your company's revenue by 15% without adding a single new customer? According to research by McKinsey, strategic pricing optimization delivers measurable financial impact that goes far beyond traditional revenue management approaches.

B2B pricing managers and revenue strategists face an increasingly complex challenge: demonstrating concrete financial value from their strategic initiatives. Traditional pricing models often rely on intuition rather than data-driven insights, leaving critical financial opportunities unexplored and ROI calculations frustratingly opaque.

Calculating the true return on investment for pricing strategies requires a sophisticated approach that blends quantitative analysis, market intelligence, and strategic financial modeling. By understanding how to systematically measure and validate pricing strategy performance, organizations can transform pricing from a tactical function into a powerful revenue acceleration engine.

Understanding the Basics of Pricing Strategy ROI

Return on Investment (ROI) in pricing strategy represents the financial gain or loss generated by specific pricing decisions, measured as a percentage of the investment made. At its core, pricing strategy ROI quantifies how effectively your pricing approaches translate into increased revenue, improved profit margins, and enhanced market competitiveness.

For B2B executives and revenue strategists, calculating pricing strategy ROI is more than a mathematical exercise—it's a critical strategic tool. This metric helps organizations validate the financial impact of pricing initiatives, justify strategic investments, and make data-driven decisions that directly influence bottom-line performance.

Effective ROI calculation involves tracking key performance indicators such as revenue growth, profit margin changes, customer acquisition cost, and market share shifts. By systematically measuring these metrics, businesses can transform pricing from a reactive function into a proactive revenue optimization mechanism that delivers measurable financial value.

Why Pricing Strategy ROI Matters for Your Business

B2B companies and SMBs operate in a dynamic market where every strategic decision carries significant financial implications. Pricing strategy ROI isn't just a theoretical concept—it's a powerful lever for sustainable business growth and competitive differentiation.

Key Benefits of Strategic ROI Analysis

- Enhanced Market Penetration: By precisely understanding pricing impact, businesses can identify optimal price points that attract more customers without sacrificing profitability.

- Improved Product-Market Fit: ROI calculations reveal how pricing aligns with customer perceived value, enabling more targeted and resonant market positioning.

- Risk Mitigation: Data-driven pricing strategies reduce the likelihood of revenue leakage and minimize potential market share erosion.

- Competitive Intelligence: Systematic ROI tracking provides insights into how pricing strategies compare against industry benchmarks and competitor approaches.

Common Pricing Strategy Pitfalls

Many organizations stumble by:

- Relying solely on cost-plus pricing models

- Neglecting ongoing price elasticity analysis

- Failing to segment pricing strategies across different customer groups

- Overlooking the psychological aspects of pricing perception

Recognizing these challenges transforms pricing from a reactive function into a strategic growth mechanism that directly impacts financial performance.

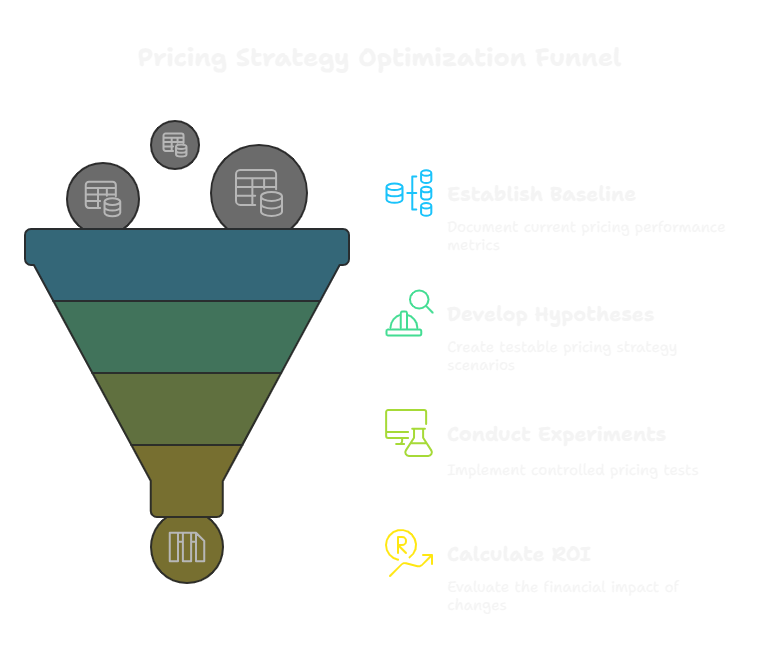

Step-by-Step Process for Calculating Pricing Strategy ROI

Step 1: Define Clear Baseline Metrics

Establish a comprehensive baseline by documenting current pricing performance. This involves collecting precise data on:

- Current average selling price

- Existing profit margins

- Sales volume across product lines

- Customer acquisition costs

Pro Tip: Use historical financial data from the past 12-18 months to create a robust baseline. Integrate data from CRM, sales, and financial management systems for comprehensive insights.

Avoid: Relying on incomplete or siloed data sources that don't provide a holistic view of pricing performance.

Step 2: Develop Pricing Strategy Hypotheses

Create measurable hypotheses about potential pricing interventions. Focus on specific, testable scenarios such as:

- Segment-specific pricing adjustments

- Volume discount modifications

- Competitive price positioning changes

- Value-based pricing models

Pro Tip: Use statistical modeling to simulate potential pricing scenarios before full implementation. This reduces risk and provides predictive insights.

Avoid: Making blanket pricing changes without targeted hypothesis testing.

Step 3: Implement Controlled Pricing Experiments

Execute pricing strategy changes through controlled, measurable experiments. Key implementation strategies include:

- A/B testing for pricing variations

- Segmented rollout across customer groups

- Time-bound pricing interventions

- Detailed tracking of performance metrics

Pro Tip: Leverage advanced analytics tools that can provide real-time performance tracking and automated ROI calculations.

Avoid: Implementing pricing changes across entire product lines without preliminary testing.

Step 4: Calculate Comprehensive ROI Metrics

Quantify the financial impact using a multi-dimensional ROI calculation:

- Revenue impact percentage

- Profit margin changes

- Customer retention rate shifts

- Market share movement

Pro Tip: Use the formula: ROI = (Net Return from Pricing Strategy / Total Investment) × 100 to standardize calculations.

Avoid: Focusing exclusively on top-line revenue while neglecting profitability and long-term strategic implications.

Essential Tools and Frameworks for Pricing Strategy ROI Analysis

Recommended Tools for Pricing Strategy ROI

-

Price Intelligently by ProfitWell

A comprehensive pricing analytics platform that helps B2B companies conduct granular pricing research and optimize subscription-based revenue models. Provides advanced segmentation and real-time pricing performance tracking.

-

Vendavo Pricing Solutions

Enterprise-grade pricing optimization software that leverages AI and machine learning to generate predictive pricing insights. Ideal for complex B2B environments with multiple product lines and customer segments.

-

Pricing Dynamics by PROS

An AI-powered platform that enables dynamic pricing strategies across different market conditions. Offers robust analytics for understanding price elasticity and competitive positioning.

-

Zilliant Price IQ

Advanced pricing intelligence tool that integrates with existing CRM and ERP systems, providing automated pricing recommendations based on market data and internal performance metrics.

Strategic Pricing Frameworks

-

Value-Based Pricing Framework

Centers pricing strategies around the perceived customer value rather than traditional cost-plus models. Helps businesses align pricing with customer expectations and market dynamics.

-

Economic Value Assessment (EVA)

A comprehensive approach that quantifies the total economic value a product or service delivers to customers. Enables more precise pricing strategies by understanding differentiated value propositions.

-

Pricing Maturity Model

A structured methodology for assessing and evolving an organization's pricing capabilities. Provides a roadmap for progressively sophisticated pricing strategy development.

-

Competitive Pricing Positioning Framework

Helps businesses strategically position their pricing relative to competitors while maintaining unique value differentiation. Supports dynamic pricing adjustments based on market intelligence.

Pro Tip: Select tools and frameworks that integrate seamlessly with your existing technology stack and align with your specific business model and strategic objectives.

Avoid: Overinvesting in complex tools without a clear understanding of your specific pricing optimization needs.

Conclusion: Turning ROI Insights into Strategic Pricing Advantage

Mastering the calculation of ROI for pricing strategies is not just a numerical exercise but a critical strategic imperative for modern B2B organizations. By systematically implementing robust measurement frameworks, revenue strategists can transform abstract pricing decisions into tangible financial outcomes, creating a continuous improvement cycle that drives competitive differentiation. The sophisticated approach of integrating granular cost analysis, comprehensive market segmentation, dynamic elasticity modeling, and advanced attribution techniques empowers businesses to not only understand their current pricing performance but also predictively optimize future go-to-market initiatives. As pricing complexity increases and market dynamics become more volatile, those who invest in rigorous ROI measurement will consistently outperform competitors, turning pricing from a transactional function into a strategic lever of sustained competitive advantage and profitability.